Women and Finance - What You Need to Know!

Statistically, women are more likely to outlive men, but they earn less and are more likely to take time off to care for their family members. Although they may save a slightly higher percentage of their paychecks than men, they have less set aside due to being more risk-averse and the fact that, generally, they find investments and finances overwhelming and complicated.

This creates a two-fold problem: the potential to not have enough money to last throughout retirement, and being thrust into a position of having to handle all the family finances (becoming the “CFO” of the household) if their spouse passes away first. Throughout my career, when speaking to women about life, disability, health, and retirement concerns, the majority were unaware of what they have, what their expenses are, and how their individual and family savings will affect them in the future. Most assumed that their husbands were taking care of everything and that they didn’t need to know that information.

In a way, I understand that. As the wife and mother of a household with grade-school children, delegating a “confusing,” “overwhelming,” and “boring” task like paying the bills, handling taxes, and making investment decisions seems like a no-brainer with all the other items that need to be juggled (I’m still trying to delegate the laundry). But in the end, this doesn’t serve the women we love well. Here are a few tips that can help women (and men) navigate the CFO hurdle, as well as elevate their own financial success.

Involvement of Goals and Status:

Have a discussion at least annually (tax time can be a good time to reflect on “The State of the Union”) about where you are financially, the kind of shared vision you have for the future, and the steps needed to get there. Reviewing wills, insurance policies, and beneficiary designations on anything that will pay money out to anyone is vitally important. When reviewing your retirement accounts, insurance policies, and investment holdings, ensure they are up to date with the appropriate amount of coverage, properly funded, and aligned with the level of risk and diversification suitable for your goals and time horizon.

There are numerous sites to help, such as Mint.com, PersonalCapital.com, and Vanguard for investing, but you may have a higher chance of financial success if you have a financial advisor who is sensitive to your and your spouse’s needs, goals, and risk tolerances. Numerous studies have shown that women are most likely to fire their financial advisor once their spouse passes due to a poor understanding of their needs. Women are looking for someone to relate the financial side of life to… life! A competent financial advisor can help with difficult conversations about money, create a financial plan suited to your lifestyle and needs, and organize, implement, and manage the tools to get you to your goals while ensuring you do not take on unnecessary risks or costs.

Passwords:

My husband uses a separate password-keeping system, and even though the mortgage, property taxes, etc., are paid through our joint account, I didn’t realize he was going in on a monthly basis and retrieving the utility bill with a separate password (a good example of delegating). He potentially has other accounts with usernames and passwords (investment, health, computer administration, etc.) that may have changed since the last time I thought of them. Having access to your significant other’s passwords is a crucial timesaver.

Important Files:

Recently, a client of mine was desperately looking for a life insurance policy that her now-deceased father-in-law mentioned he had. Please note that there are insurance companies that will not check to see if the insured has passed away in order to avoid paying a claim to the listed beneficiary. It is extremely important that these policies and policy descriptions be kept in one place so that someone can file a claim on your behalf.

Additionally, many newer insurance and annuity policies have chronic and critical illness benefits that can be paid out in the event of a stroke, heart attack, coma, or memory disorders. Having easily accessible information about what is included in your plans will allow your spouse or family member to ensure you get the financial assistance you’ve paid for and provide a significant measure of dignity and choice if a chronic or critical concern arises. Working with a holistic financial advisor can also help ensure you are covered in these areas and break down what you currently have and what you need.

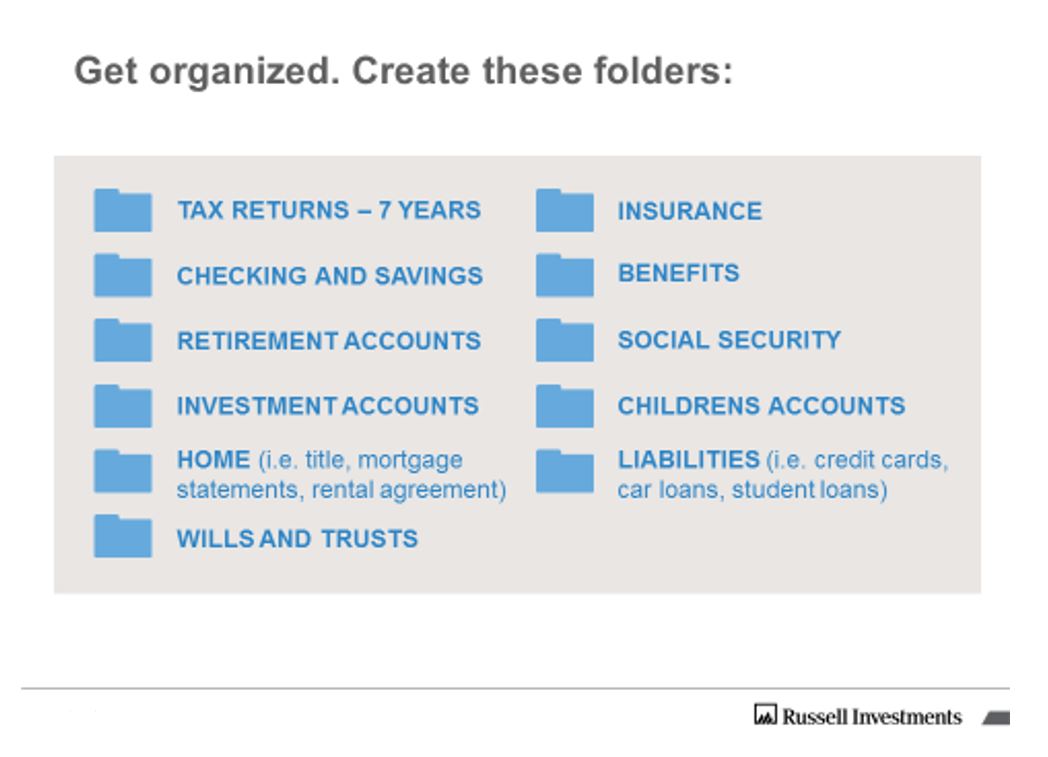

Below is a snapshot, courtesy of Russell Investments, of what files should be set aside and placed into a fireproof/waterproof safe:

Additional information such as funeral arrangements, plot details and specific items that you’d like your loved ones to have should be included in these files.

Contact Info: If you use a CPA/Accountant, Lawyer, Financial Advisor, Agent, or Investment Broker, including their information and contact details in your safe is important in case information goes missing.

Communication and other Family Members: My father, years ago, asked me to be the executor (or executrix to be grammatically correct) of his estate when he passes away. He gave me the combination code to his fireproof safe, which holds his important documents.

Would you believe that he changed his box a while ago and now has a wildly different digital number? If you are or will be potentially responsible for handling your parents’ affairs or the affairs of other loved ones in your life, don’t assume that things have stayed the same!

Final Thought: Some people (women, parents, children, men) may view these discussions as “morbid”, and that money discussions are private, taboo and/or overwhelming. If you need help starting a conversation with a spouse or a loved one, want to stress test your current financial plan (or need to start one), or just want to review what you have to make sure it’s current - shoot me an email or give me a call.

Starting these conversations now, when there is no stress, will go a long way to not only ensure financial success, but also make the potential transition to “Family CFO” go more easily.

To Your Health & Wealth!

Wendy Pyne,