Why Financial Planning Matters: A Roadmap to Your Future

In an era of economic uncertainty, rapid technological change, and evolving life expectations, securing your financial future has never been more critical. Financial planning isn't just about crunching numbers or saving for a rainy day; it's a comprehensive strategy that serves as your personal roadmap to achieving long-term goals, weathering life's storms, and building a legacy that lasts. As a financial advisor with over 20 years of experience at Protegro®, Inc., I've seen firsthand how proactive planning transforms lives. Whether you're a young professional starting out, a family navigating mid-life challenges, or someone approaching retirement, understanding why financial planning matters can empower you to take control of your destiny.

1. Setting Clear Goals and Priorities

At its core, financial planning begins with defining what success looks like for you. Do you dream of buying a home, funding your children's education, traveling the world, or retiring comfortably? Without a plan, these aspirations can remain vague wishes. A well-crafted financial plan helps you articulate your objectives, prioritize them, and break them down into actionable steps.

For instance, consider a couple in their 30s aiming to retire by age 60. Through financial planning, we assess their current income, expenses, assets, and liabilities to create a timeline. This might involve budgeting tools, investment strategies, and savings targets tailored to their risk tolerance. The result? A sense of direction that reduces stress and increases motivation. Studies show that individuals with written financial plans are more likely to achieve their goals, as the process fosters discipline and accountability.

2. Managing Risks and Building Resilience

Life is unpredictable; job loss, health issues, market downturns, or even global events like pandemics can derail your finances overnight. Financial planning acts as a safety net, identifying potential risks and implementing safeguards to protect your wealth.

Key elements include emergency funds (ideally covering 3-6 months of expenses), insurance coverage (life, health, disability, and long-term care), and diversified investments to mitigate market volatility. At Protegro, we emphasize holistic risk management, incorporating tools like annuities or bonds to provide stability. By anticipating challenges, you not only survive tough times but thrive, emerging stronger and more prepared.

3. Optimizing for Taxes and Efficiency

Taxes can erode your hard-earned wealth if not managed properly. Effective financial planning involves strategies to minimize tax liabilities while maximizing returns. This could mean leveraging tax-advantaged accounts like 401(k)s, IRAs, or Roth conversions, or timing withdrawals in retirement to stay in lower tax brackets.

For high-net-worth individuals or business owners, advanced techniques such as charitable giving, estate planning, or qualified opportunity zones can further enhance efficiency. In my practice, I've helped clients save thousands by aligning their plans with current tax laws, ensuring more money stays in their pockets for growth and enjoyment.

4. Preparing for Retirement and Longevity

With life expectancies on the rise, many people now living into their 90s, retirement planning is no longer optional. Financial planning ensures you have sufficient resources to maintain your lifestyle without outliving your savings. This involves calculating your "retirement number," factoring in inflation, healthcare costs (which can exceed $300,000 per couple), and Social Security optimization.

A personalized plan might include a mix of stocks, bonds, real estate, and alternative investments to generate income streams. It's about creating a sustainable withdrawal strategy, like the 4% rule, adjusted for your unique circumstances. The peace of mind from knowing you're set for the long haul is invaluable.

5. Creating a Lasting Legacy

Financial planning extends beyond your lifetime… It's about legacy building. Whether through wills, trusts, or beneficiary designations, a solid plan ensures your assets are distributed according to your wishes, minimizing family disputes and estate taxes. For those with philanthropic goals, it can facilitate impactful giving.

As a Certified Divorce Financial Analyst® (CDFA®), I've assisted clients in navigating complex situations like divorce, where equitable asset division is crucial. At Protegro, we focus on intergenerational wealth transfer, helping families preserve and grow their fortunes for future generations.

Start Your Journey Today

Financial planning isn't a one-time event; it's an ongoing process that evolves with your life stages. By investing time and effort now, you're not just planning for the future, you're shaping it. The benefits, such as financial security, reduced anxiety, and the freedom to pursue your passions, are profound.

If you're ready to chart your course, I invite you to connect with me at Protegro. As an Investment Advisor Representative with a passion for empowering clients, I'm here to guide you every step of the way. Visit our website or schedule a consultation to begin building your roadmap to a brighter future. Remember, the best time to start financial planning was yesterday; the next best time is today.

Why Work with Protegro®?

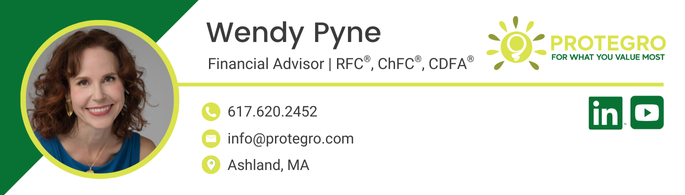

Wendy Pyne, RFC®, ChFC®, CDFA®, offers unmatched expertise in navigating the financial complexities of divorce. As a fee-only financial planner and fiduciary, she provides objective, personalized advice that prioritizes your best interests.

At Protegro, we:

Help uncover and accurately value all marital assets.

Provide clear, objective analysis of financial options during settlement discussions.

Design a post-divorce financial plan tailored to your goals and values.

Divorce is a pivotal moment in your financial life. With Protegro® by your side, you’ll have the clarity and support to make confident, informed decisions that protect your future.

Contact Protegro® today to start your journey toward financial empowerment.